| Having trouble seeing this email? Click here to view it online. | |

| BenefitsPro.com | Renew Your Subscription | eNewsletters | Benefits Selling Expo | Free Product Info | ||||||||

|

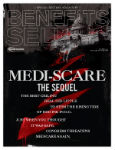

%%fullname%%, Medicare may have been the single most-debated program during the recent debt ceiling talks. Certainly, it was a key cause of stonewalling by legislators on both sides of the Congressional aisle, as neither party wants to be associated with anything that potentially hurts beneficiaries. Read more in the Benefits Selling October issue. And, developing a business around big clients can be time consuming, labor intensive and costly. And once the client is signed up, brokers have to continue working closely with them to make sure they stay clients. But big clients are worth it. Plus, voluntary sales overall are down from a couple years ago. Confidence has dipped. But some brokers say it’s preparing itself for future growth. Here’s how to read between the numbers of voluntary surveys. Best regards,

Medi-Scare: The sequel

|

|

|||||||

Thinking bigDeveloping a business around big clients can be time consuming, labor intensive and costly. And once the client is signed up, brokers have to continue working closely with them to make sure they stay clients. But big clients are worth it. |

||||||||

Any volunteers?Have you considered voluntary benefits to offset your agency's lost income? |

||||||||

Light near the end?Overall, voluntary sales are down from a couple years ago. Confidence has dipped. But some brokers say it's preparing itself for future growth. Here's how to read between the numbers of voluntary surveys. Click to continue... |

||||||||

|

||||||||

|

|

||||||||

| More BenefitsPro.com eNewsletters : BenefitsPro Daily | BenefitsPro News Alert | Benefits Broker Pro | Consumer Driven Online | Benefits Manager Pro | Retirement Advisor Pro |

||||||||